Why you should challenge your property tax assessment

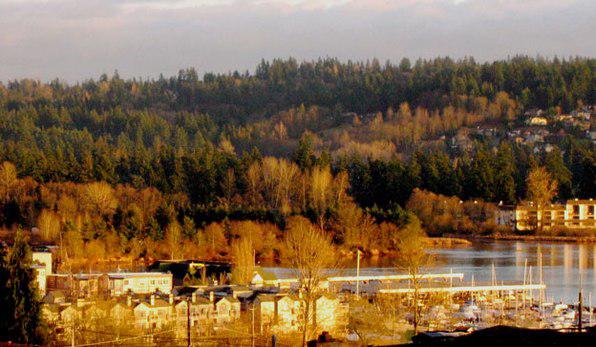

When it comes to tackling high property taxes, you don’t have to accept a number without closer inspection. Challenging your property tax assessment with a real estate appraisal can help to reduce your overall liability and save money in the long term. If your research reveals that the value at which your home was assessed is more than what it’s worth, then an appeal may be in order. Numerous factors contribute to how much one pays: additions, maintenance, and location — all can play into the changing value of a property over time. With a professional real estate appraisal completed in Kenmore, WA, you will have unbiased and impartial evidence for your case when taking corrective measures or simply trying to understand why your property tax bill may differ from comparable homes in the area.

How a real estate appraisal can help you challenge your tax assessment in Kenmore, WA

As a property owner in Kenmore, WA, your taxes are based on a governmental assessment of the value of your home. However, the assessment process is not always accurate and may be based on estimations that do not reflect the true value of your property. To help you secure a fairer tax burden, you can acquire an independent real estate appraisal to challenge the existing assessment. An experienced appraiser will inspect both the interior and exterior of your home to determine its estimated market value and compare it to the local assessments for similar properties. With this data in hand, you will have a sound basis for challenging any inflated taxes you receive with proof that your assessment was overly high.

What to expect from an appraiser during the appraisal process

Whether you’re contesting an unfairly increased property tax assessment or ensuring that your taxation is accurate in Kenmore, WA, hiring a real estate appraiser can help. Appraisers use their expertise to determine the market value of a property and provide a report that can be used for several purposes. As the appraisal process begins, expect customer service focused on your needs. The appraiser will take the time to explain what to expect throughout the process and answer any questions you might have. They will visit the property to assess its features and then analyze data from recent sales of comparables in the area to create an accurate estimate. Finally, they provide detailed documentation for evidence of their analysis and conclusions, ensuring you are equipped with all you need for an informed decision about your property tax assessment.

Tips for a successful property tax appeal

If you're planning to challenge your property tax appraisal in Kenmore, WA, it is important to have a successful appeal process. Start by verifying the accuracy of your assessment with a real estate appraiser and examine comparable residences in the same area. Doing research and keeping detailed records of any additional material value on your home, such as updates or new fixtures can help make a case for adjusting your valuation downwards. Keep in mind that the burden of proof rests with you during the appeals process, so it is important to be well-prepared before beginning an appeal.

A property tax assessment is supposed to be an estimation of your home’s value as of January 1st of the current year. But sometimes, the assessor gets it wrong. If you think your home was assessed at more than its fair market value, you can challenge your property tax assessment with a real estate appraisal from a professional appraiser. An appraiser will visit your home and compare it to similar properties in Kenmore, WA that have recently sold, taking into account things like lot size, square footage, age, condition, upgrades, and location. The appraiser will then provide you with a detailed report outlining their estimate of your home’s value, which may be lower than what the assessor thinks your home is worth. With this information in hand, you can appeal your property taxes and save yourself some money.